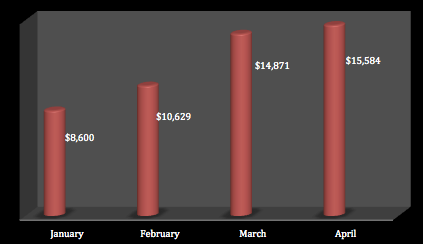

Income/Expenses, Net Worth Update – April 2015

Another month is in the books. This past week was a “study week” for us, so I was able to spend less on gas since I didn’t have to commute to school. I was able to make a lot of realized growth from stocks as well. I accomplished something substantial this month - I re-paid a loan while I was in school, something many students do not do. Let’s take a look at my expenses and the money I earned:

INCOME

Intern Pharmacist = $2,098.22

Unrealized/Realized Stock Gains = $892.34

Total = $2,990.56

EXPENSES

Gas = $132.61

Gym = $30.00

Food = $14.33

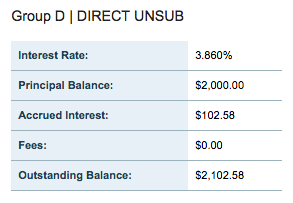

Student Loan Re-Payment = $2,102.58

Total = $2,279.52

Overall April Month Gain = +$711.04

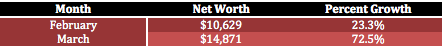

Net Worth Update

Another month is in the books. This past week was a “study week” for us, so I was able to spend less on gas since I didn’t have to commute to school. I was able to make a lot of realized growth from stocks as well. I accomplished something substantial this month - I re-paid a loan while I was in school, something many students do not do. Let’s take a look at my expenses and the money I earned:

INCOME

Intern Pharmacist = $2,098.22

Unrealized/Realized Stock Gains = $892.34

Total = $2,990.56

EXPENSES

Gas = $132.61

Gym = $30.00

Food = $14.33

Student Loan Re-Payment = $2,102.58

Total = $2,279.52

Overall April Month Gain = +$711.04

Net Worth Update

I did achieve a milestone this month, which was paying back my first student loan. Check out my progress on my milestones in the "short term goal" tab. I likely won’t be making another bulk loan payment for a few months, so I expect my net worth to grow over $20,000 very soon. Overall, I was able to save 24% of my earnings in April, even while paying a large amount of student loans!

What do you guys think? How much did you save this April? Leave your thoughts in the comments!

What do you guys think? How much did you save this April? Leave your thoughts in the comments!

RSS Feed

RSS Feed